A prenuptial agreement, commonly referred to as a prenup, is a legally binding contract created by two people before they are married. It outlines what each person’s assets and debts are prior to the marriage and establishes procedures for dividing property and assets if the couple were to divorce. Prenups are recognized as valid and enforceable in all 50 states. They can help protect both parties and allow a couple to enter into marriage with a clear financial arrangement already in place.

Prenups often specify who gets what in a divorce and how much. For example, a prenup may indicate that assets belonging to one spouse before the marriage, like a family business, will remain that spouse’s separate property following a divorce. It may also lay out specific dollar amounts that one spouse will receive if the marriage ends. Other typical prenup provisions include:

– How joint bank accounts will be divided

– Who gets the house

– Who gets custody of any pets

– Who will pay what debts

– Whether one spouse will receive alimony

For a prenup to be valid, both parties must voluntarily enter into it without undue pressure or coercion. Each side needs to provide full financial disclosure and have their own lawyer review the agreement. There must be consideration on both sides, meaning each person is giving up something in exchange for what they are getting. For prenups signed shortly before a wedding, courts may scrutinize them more closely to ensure proper financial disclosure was provided and that there was no duress or lack of time to review.

Benefits of Prenuptial Agreements

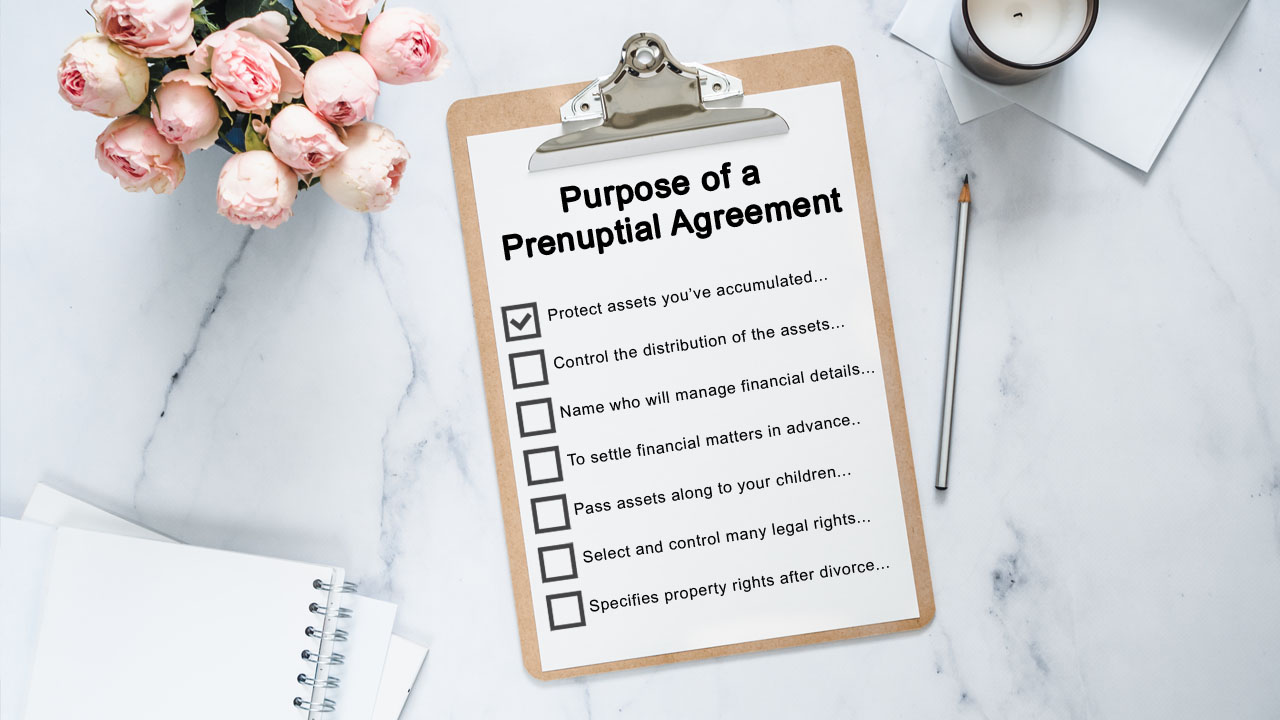

There are several potential benefits to having a prenup:

– Defines expectations upfront. A prenup allows you to discuss finances, assets, debts, spousal support, and more before emotions run high. Getting it all out in the open early on can prevent disagreements down the road.

– Protects personal assets. Prenups allow people to keep their own property separate, like a family business, inheritance, real estate, or investments. These assets remain under your control if the marriage ends.

– Speeds up divorce process. Because the division of assets is already agreed to, it can make divorce quicker, simpler, and less costly.

– Encourages open communication. Creating a prenup requires honest financial disclosure by both individuals, which builds trust and understanding.

– Reduces conflict during divorce. A prenup eliminates much of the fighting couples go through over money and property during divorce proceedings.

Of course, prenups are not for everyone. Those with fewer assets and debts may not find them necessary. But for many couples, especially those getting remarried or those with substantial individual assets, a prenuptial agreement can give both spouses greater peace of mind and control over their financial futures.